Export Touchdown: How the Soybean Checkoff Helped Move the Chains Globally

U.S. soybean exports scored big in the 2024 – 2025 marketing year (MY) thanks to market diversification efforts by your soybean checkoff team. The United States exported 2.5 billion bushels of U.S. soy during the 2024/25 marketing year. According to data from the United States Department of Agriculture, that’s a 12.8% increase year-over-year (YOY) and a 2.95% increase over the 5-year average.

These extra points were supported by export growth in whole soybeans, soybean meal and soybean oil with increases of 10.7 percent, 13.9 percent and 304 percent, respectively, from the previous marketing year.

“We had a tough harvest season in 2024 with severe drought followed by hurricane rains, but farmers were able to create a quality crop with the hands they were dealt,” said Bill Bayliss, Logan County farmer and past chairman for the Ohio Soybean Council in 2024-2025. “Our international customers know that U.S. soybeans are the best and that we will deliver despite the odds.”

Whole Soybeans

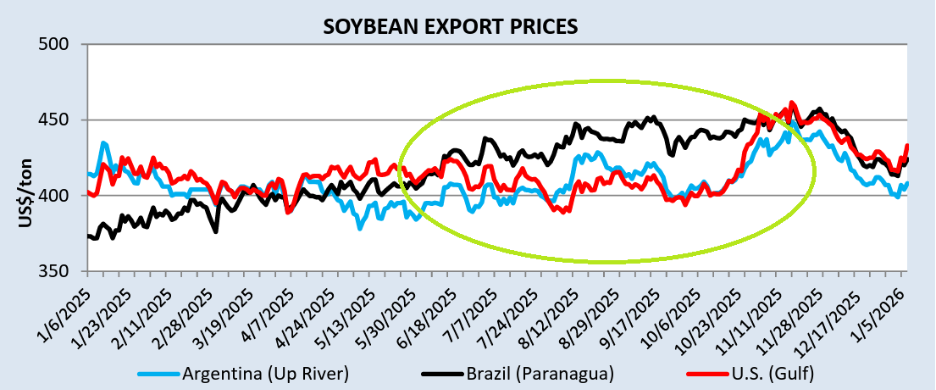

Late in the 2024/25 marketing year, U.S. soybeans were priced at a “discount” compared to our South American competitors. This is mainly due to China’s demand for South American beans over U.S. beans. This caused other countries to jump on the opportunity to purchase quality U.S. soybeans at a lower-than-normal price. U.S. soybean export value totaled $22.3 billion dollars, about an 8 percent decrease from the prior MY. We saw large growth in soybean exports to Egypt, the European Union, Vietnam and Turkey.

USDA Oilseeds: World Markets and Trade, January 2026.

The Ohio Soybean Council has worked closely with the U.S. Soybean Export Council to keep U.S. Soy at the forefront of Egyptian importers’ minds. U.S. Soy collaboration began in Egypt in 1988. With funding from the soybean checkoff and governmental programs, USSEC opened the world’s first Soy Excellence Center (SEC) in Egypt in 2019. The SECs are educational programs for mid-tier employees at companies along the soybean value chain. In Egypt, the SECs focus on the value U.S. Soy brings to feed mill, poultry and aquaculture operations, building relationships and more efficient utilization systems.

Soybean Meal

With increased crush capacity in the U.S. driven by domestic biofuel demand for soybean oil, new opportunities are needed to move soybean meal. Animal agriculture is the number one consumer of soybean meal, utilizing 97 percent of production. U.S. domestic livestock consumes approximately 67 percent of the soybean meal produced in the U.S., according to the United Soybean Board, and 30 percent goes to international markets.

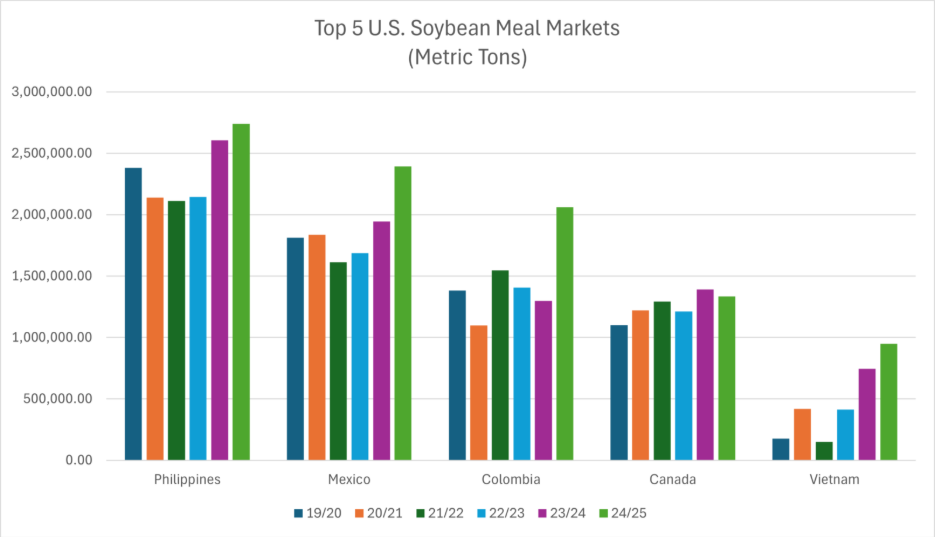

Since 2020, U.S. soybean meal exports have grown 32 percent, according to data from USDA. Last marketing year, the U.S. saw record soybean meal exports at 16.56 million metric tons – equivalent to 786 million bushels of soybeans or 17 percent of 2024 U.S. soybean production. Higher imports by the Philippines, Mexico, Colombia and Vietnam contributed to the record soybean meal exports.

USDA, FAS Global Agriculture Trade System, 02/05/2026

Soybean checkoff efforts help promote soybean meal consumption in mature and emerging markets. U.S. soybean meal exports rose 59 percent to Colombia from MY 23/24 and 24/25. The livestock industry and consumer demand for eggs, poultry, pork and fish have continued to drive the demand for soybean meal. The soybean checkoff invests in research that demonstrates the added value U.S. soybeans give to international livestock markets.

Soybean Oil

The value of U.S. soybean oil still competes on the global scale. In MY 24/25, U.S. soybean oil exports totaled 1.13 million metric tons, a three-fold increase over the previous marketing year. This increase was driven by imports from the world’s largest importer of vegetable oil, India. Top markets included India, Mexico, Colombia and Venezuela.

U.S. soybean oil continues to compete with soy oil from South America as well as palm oil from Malaysia and Indonesia. Continuing to promote the health benefits of U.S. soybean oil in human diets keeps doors open for U.S. soy exports.

Uncertainty still exists in the international space with soybeans taking center stage. As of January 29, 2026, U.S. soybean export sales since September 2025 were 55 percent lower than they were during the same period last year. Recent sales to China have helped close the gap between current export numbers and the recent 5-year average, but losing consistent buying from our largest buyer has created a dent and a need to diversify markets. The soybean checkoff’s investment in international marketing returns $18 for every $1 invested. Through educational programs along the soybean value chain, research supporting domestic biofuel usage, new soy-based product development, and continuous marketing on an international scale will grow opportunities for U.S. soybean farmers.